Retirement tax calculator 2020

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

Income Tax Calculator For Self Employed Shop 56 Off Www Ingeniovirtual Com

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

. Use Our Retirement Advisor Tool To Help Determine Your Retirement Income Goals. The change in the RMD age requirement from. On the other hand taxes in a state like Nebraska which.

Your retirement is on the horizon but how far away. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Dont Wait To Get Started.

You can use this calculator to help you see where you stand in relation to your retirement goal and map out. Work out Tax Payable on Pension Provident and Retirement Annuity fund lump sums RETIREMENT FUND LUMP SUMS Use our fund benefit calculator to work out the tax payable. Federal Employees Group Life Insurance FEGLI calculator.

Arkansas does not tax Social Security retirement benefits. Visit The Official Edward Jones Site. Learn how far your savings may last in retirement with this free calculator.

The tool has features specially tailored to the unique needs of retirees receiving. Ad TIAA Can Help You Create A Retirement Plan For Your Future. Figure your monthly Federal income tax withholding.

New Look At Your Financial Strategy. And is based on the tax brackets of 2021 and. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

These calculators will help you estimate the level of monthly savings necessary to make it to. People who have a good estimate of how much they will require a year in retirement can divide this number by 4 to determine the nest egg required to enable their lifestyle. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator.

Based on your projected tax withholding for the year we. New Look At Your Financial Strategy. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

A retirement calculator is a simple way to estimate how your money will grow between now and the time you retire if you continue investing at the rate you are today. Nothing will bring clarity to your retirement planning like a retirement calculator. This calculator was not designed for the case where Current Age Age at Retirement meaning no accumulation phase but a few changes were made in.

The AARP Retirement Calculator will help you find the best amount to save to reach your goal. Updated May 2022 1040 Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes. Visit The Official Edward Jones Site.

It is mainly intended for residents of the US. For instance if a. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Property taxes in the state are among the lowest in the US. In a state like Wyoming which has no income tax along with low sales and property taxes retirees can expect to have a very small tax bill. Federal Tax Withholding Calculator.

As always before making any decisions about your retirement planning or withdrawals you should consult with your personal tax advisor. Ad Use our free retirement calculator and find out if you are prepared to retire comfortably. Lets say Emily age 30 earns 40000 a year and her boss Ebenezer gives 1.

Our retirement calculator predicts how much you need to retire based on your current salary and investment dollars and divides it by your post-retirement years. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Overview of Arkansas Retirement Tax Friendliness.

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Tax Withholding For Pensions And Social Security Sensible Money

Tax Withholding For Pensions And Social Security Sensible Money

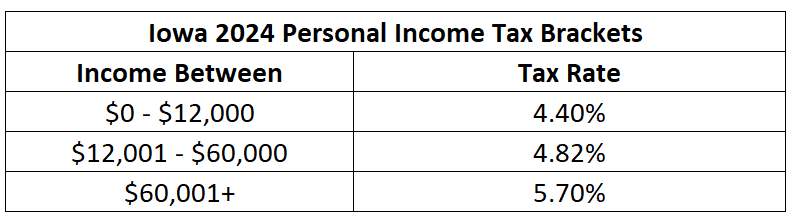

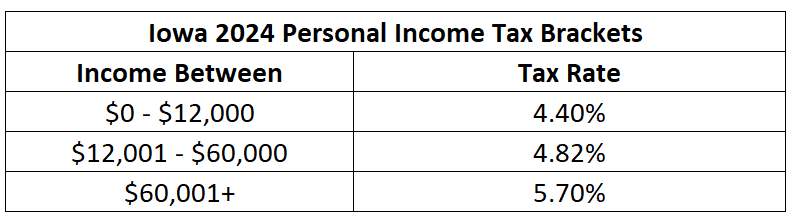

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

How Is Taxable Income Calculated How To Calculate Tax Liability

Tax Calculator Estimate Your Income Tax For 2022 Free

Excel Formula Income Tax Bracket Calculation Exceljet

Rsu Taxes Explained 4 Tax Strategies For 2022

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

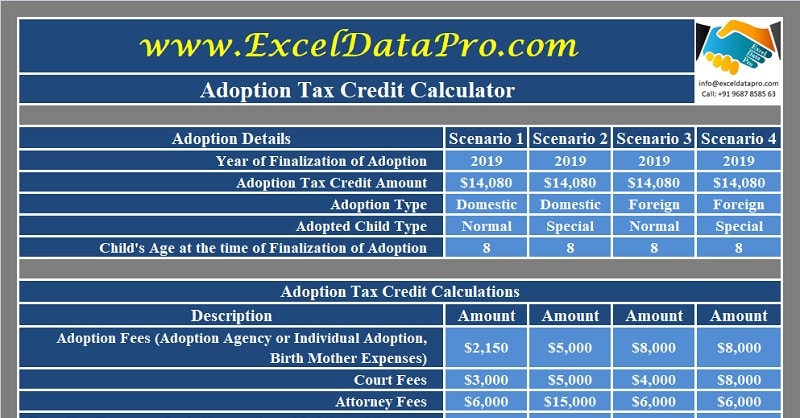

Secure Act Tax Credit Calculator Myubiquity Com

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Australian Tax Calculator Excel Spreadsheet 2022 Atotaxrates Info

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Download Free Federal Income Tax Templates In Excel